ETFGI reports Environmental, Social, and Governance (ESG) ETFs and ETPS listed globally gather net inflows of US$856 Mn during November 2018

ETFGI reports Environmental, Social, and Governance (ESG) ETFs and ETPS listed globally gather net inflows of US$856 Mn during November 2018

LONDON — December 27, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$856 Mn during November. Total assets invested ESG ETFs and ETPs increased by 6.64% from US$21.77 Bn at the end of October, to US$23.22 Bn, according to ETFGI’s November 2018 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets invested in ESG ETFs and ETPs listed globally rose 6.64% to $23.22 Bn by the end of November.

- ESG ETFs and ETPs listed globally gathered $856 Mn in net new assets during November.

- Year-to-date, ESG ETFs/ETPs assets have increased 33.8% compared to 4.6% for all ETFs/ETPs listed globally.

“While trade talks continue to make noise in the headlines, the very real prospect of slowing global growth appears to be filtering into market sentiment. A seemingly more reposed approach to monetary policy along with the China-US trade truce provided enough of a tailwind to lift US markets to finish in the green by the end of November, with the S&P 500 gaining 2.04% over the month bringing the year-to-date gain to 5.11%. Apart from the Eurozone, where various domestic issues continue to dominate, most developed markets closed the month with marginal gains, the S&P developed ex-US BMI was up 0.17% in November with year-to-date declines of 9.66%. EM and Frontier markets bounced back from the October fall, finishing up 4.61% and 1.94% respectively, softening year-to-date declines to 11.15% and 8.95%” according to Deborah Fuhr, managing partner and a founder of ETFGI.

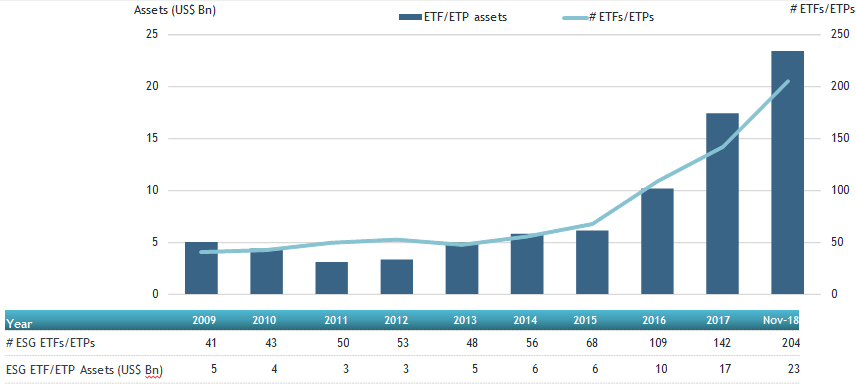

At the end of November 2018, there were 204 ESG classified ETFs/ETPs, with 473 listings, assets of $23.22 Bn, from 62 providers listed on 25 exchanges in 23 countries. Following net inflows of $856 Mn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 6.64%, from $21.77 Bn at the end of October 2018, to $23.22 Bn.

Global ESG ETF and ETP asset growth as at end of November 2018

![]()

| Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily, with 205 ESG ETFs/ETPs listed globally at the end of November. 66 new ESG ETFs/ETPs have launched during 2018, with 4 during November alone. Substantial inflows during November can be attributed to the top 20 ESG ETFs/ETPs by net new assets, which collectively gathered $873 Mn in during November. The UBS ETF (LU) MSCI World Socially Responsible UCITS ETF (UIMM GY) gathered $140 Mn, the largest net inflow in November. Top 20 ESG ETFs/ETPs by net new assets November 2018

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

### Attribution Policy ETFGI SERVICES New Service: ETFGI Global ESG ETFs and ETPs Landscape report

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services. About Deborah Fuhr Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry. |